This printed article is located at https://singaporeshipping.listedcompany.com/financials.html

Financials

Condensed Interim Financial Statements For The Six Months Ended 30 September 2025

Financials Archive![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

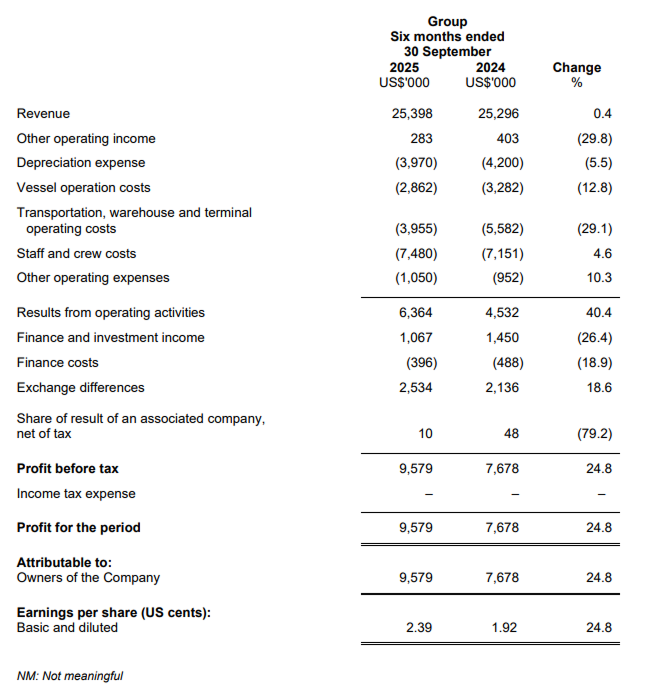

Condensed Interim Consolidated Income Statement For the six months ended 30 September 2025

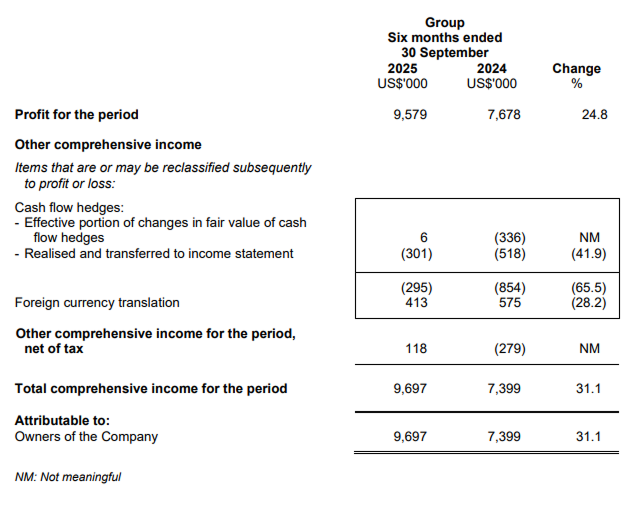

Condensed Interim Consolidated Statement of Comprehensive Income For the six months ended 30 September 2025

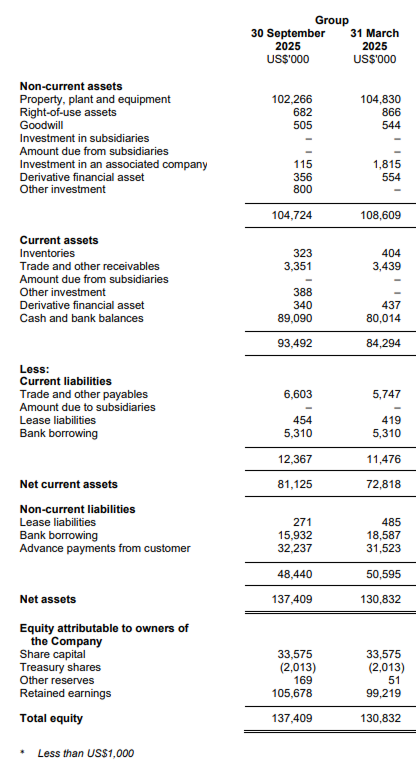

Condensed Interim Balance Sheets As at 30 September 2025

REVIEW OF PERFORMANCE OF THE GROUP

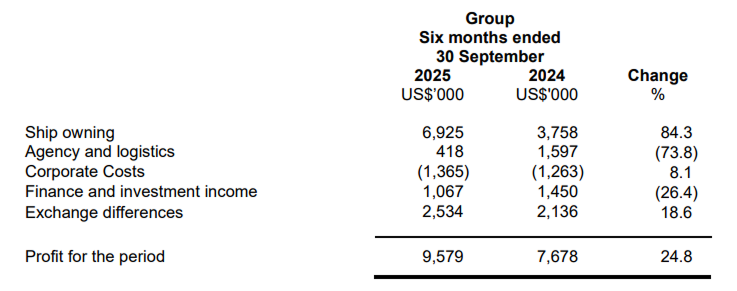

Condensed interim consolidated income statement

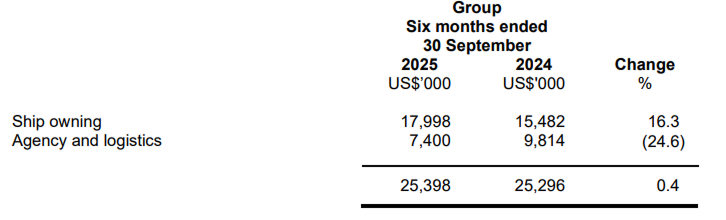

REVENUE

PROFIT ATTRIBUTABLE TO OWNERS OF THE COMPANY

- The Ship Owning segment recorded higher revenue and profit for the six months ended 30 September 2025 ("1H FY2026"), mainly attributable to the renewal of a five-year time charter for m.v. Boheme this year.

- The Agency and Logistics segment reported lower revenue and operating profit due to the fewer high-margin special projects.

- Finance and investment income declined, primarily due to lower interest rates earned on fixed deposits.

- Exchange differences mainly arise from Singapore Dollar Fixed Deposits resulted from Singapore Dollar appreciated against US Dollar.

Condensed interim consolidated balance sheet

- Reduction in value of property, plant and equipment was due to depreciation of vessels, partially offset by capitalisation of drydocking expenditure.

- Reduction in bank borrowing was due to progressive repayments made during the financial period.

Condensed interim consolidated statement of cash flows

Overall the increase of US$9.1 million in cash and bank balances was mainly due to operating cash inflows, after considering the following:

- Repayment of bank borrowing;

- Payment of dividends to shareholders; and

- Payment of drydocking expenditure.

Commentary

- Global trade continues to be in flux amid rising tariffs and geopolitical shifts. Against this backdrop, the Group continues to deliver stable results in its ship owning segment, supported by its long-term charter business model with blue-chip operators.

- The current renewal marks m.v. Boheme’s final charter period before she is retired for demolition.

- Due to ongoing market volatility, the Group remains prudent in evaluating new investment opportunities. Net of cash, the Group maintains a zero gearing position.