Condensed Interim Financial Statements For The Six Months Ended 30 September 2025

Financials Archive

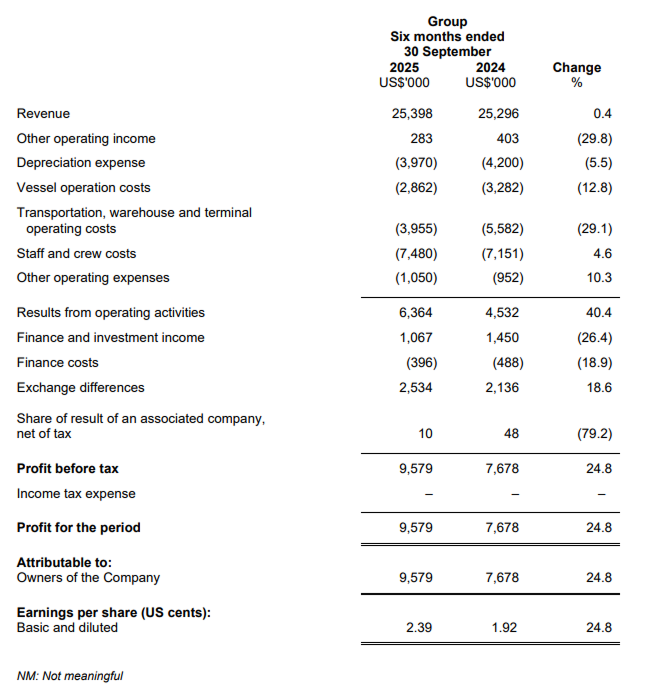

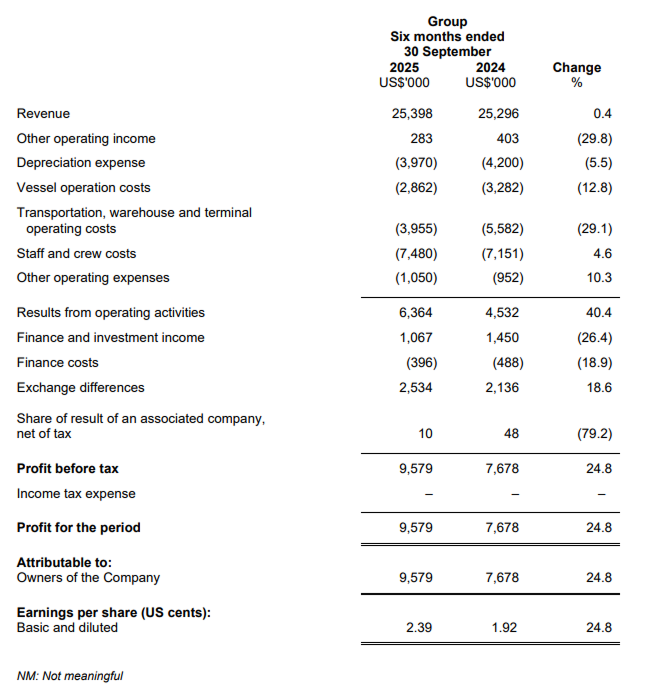

Condensed Interim Consolidated Income Statement For the six months ended 30 September 2025

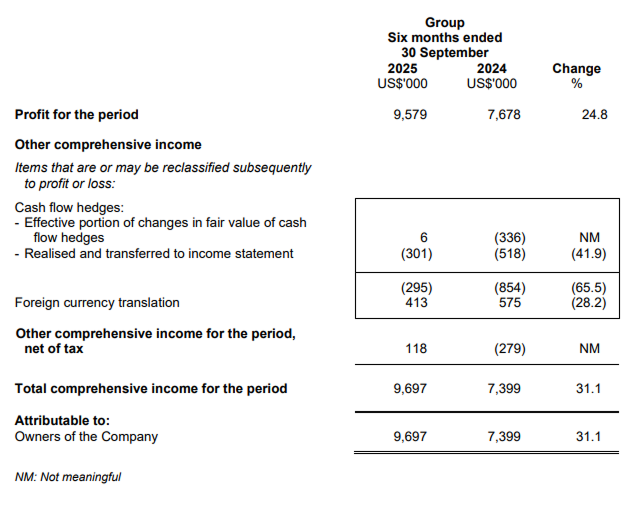

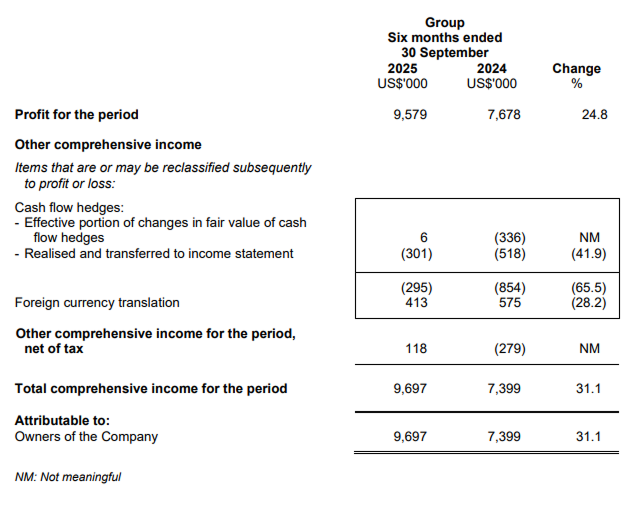

Condensed Interim Consolidated Statement of Comprehensive Income For the six months ended 30 September 2025

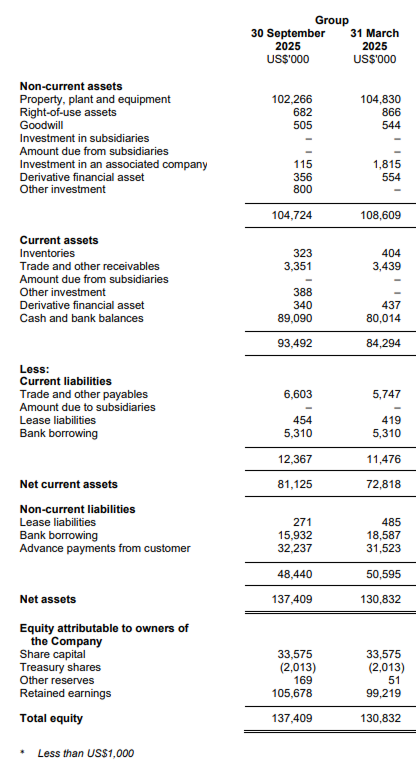

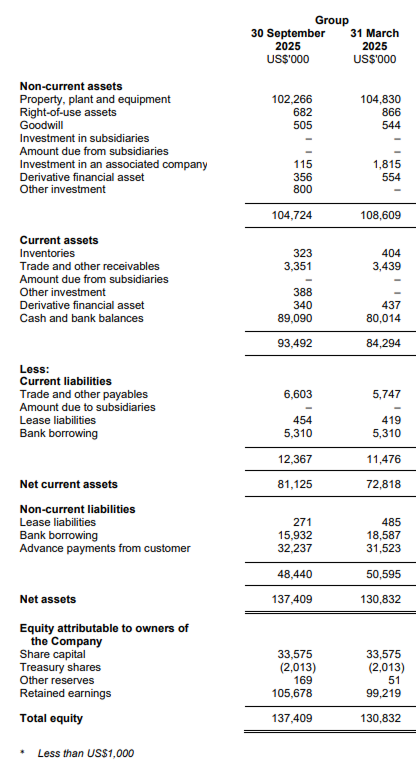

Condensed Interim Balance Sheets As at 30 September 2025

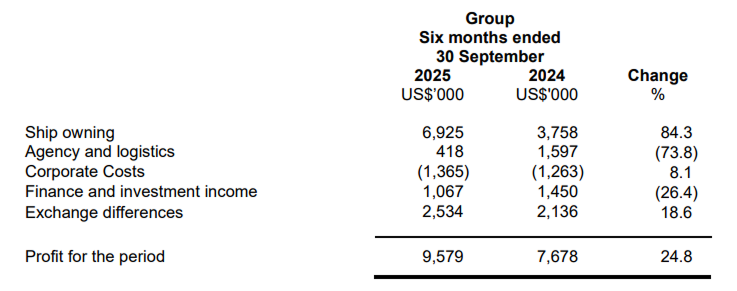

REVIEW OF PERFORMANCE OF THE GROUP

Condensed interim consolidated income statement

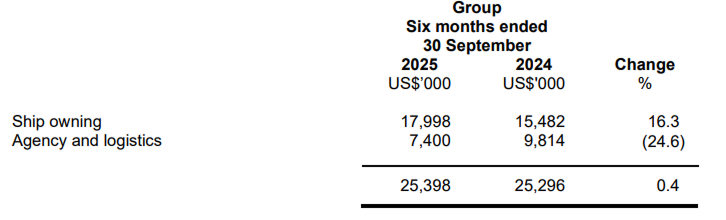

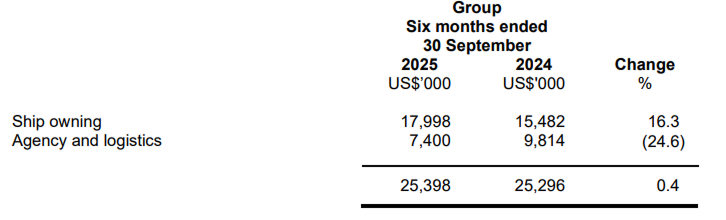

REVENUE

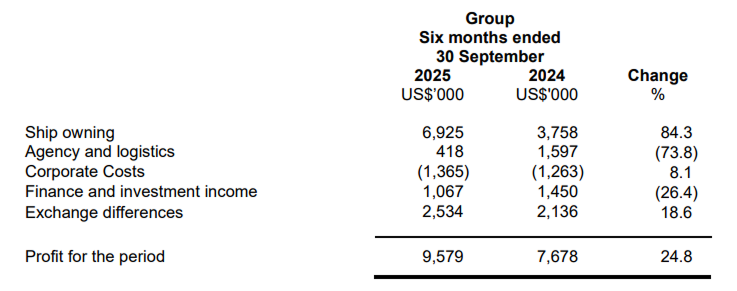

PROFIT ATTRIBUTABLE TO OWNERS OF THE COMPANY

- The Ship Owning segment recorded higher revenue and profit for the six months ended

30 September 2025 ("1H FY2026"), mainly attributable to the renewal of a five-year time

charter for m.v. Boheme this year.

- The Agency and Logistics segment reported lower revenue and operating profit due to the

fewer high-margin special projects.

- Finance and investment income declined, primarily due to lower interest rates earned on

fixed deposits.

- Exchange differences mainly arise from Singapore Dollar Fixed Deposits resulted from

Singapore Dollar appreciated against US Dollar.

Condensed interim consolidated balance sheet

- Reduction in value of property, plant and equipment was due to depreciation of vessels,

partially offset by capitalisation of drydocking expenditure.

- Reduction in bank borrowing was due to progressive repayments made during the financial

period.

Condensed interim consolidated statement of cash flows

Overall the increase of US$9.1 million in cash and bank balances was mainly due to operating

cash inflows, after considering the following:

- Repayment of bank borrowing;

- Payment of dividends to shareholders; and

- Payment of drydocking expenditure.

Commentary

- Global trade continues to be in flux amid rising tariffs and geopolitical shifts. Against this

backdrop, the Group continues to deliver stable results in its ship owning segment,

supported by its long-term charter business model with blue-chip operators.

- The current renewal marks m.v. Boheme’s final charter period before she is retired for

demolition.

- Due to ongoing market volatility, the Group remains prudent in evaluating new investment

opportunities. Net of cash, the Group maintains a zero gearing position.

![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.